巴塞尔协议三大支柱

members of the united nations face an array of financial challenges, including poverty, inequality and climate change. during their annual summit in 1992, world leaders vowed to make progress on these issues. this led to the signing of the basel accords, a set of banking regulations that would become known as the “three pillars” of the basel accords. these pillars are designed to promote banking stability, particularly when it comes to international banking and large, cross-jurisdictional transactions.

first pillar: minimum capital requirements

the first pillar of the basel accords is the minimum capital requirements. these specify the amount of minimum capital, such as cash or holding securities, a bank must have when undertaking certain activities. the goal of this pillar is to ensure that banks have sufficient funds to cover losses and liabilities. this helps ensure that banks remain in compliance with all regulations, while reducing the risk of insolvency or failure. the amount of capital that a bank must maintain is based on the perceived riskiness of its activities. a bank conducting activities involving a lower risk may require a lower amount of capital, while one engaging in more risky activities may require a higher amount.

second pillar: supervisory review process

the second pillar of the basel accords is the supervisory review process. this process involves the monitoring of banks by financial regulators to ensure that they are in compliance with applicable banking regulations. regulators must ensure that banks have sufficient capital available and that they are implementing adequate internal control measures. the supervisory review process also involves stress-testing banks to measure their ability to withstand economic and financial shocks.

third pillar: market discipline

the third pillar of the basel accords is market discipline. this pillar recognizes the need for market-based incentives and corrective measures to ensure that banks remain in compliance with regulations. market discipline is based on the idea that banks need to be held accountable for their actions. banks must regularly publish information to the public, such as financial statements, to allow the market to assess their riskiness. in addition, banks should be made aware of potential losses and have to pay for losses if their activities are deemed too risky.

the importance of the basel accords and their three pillars cannot be understated. these regulations have helped improve the safety and stability of the international banking system, making it easier for individuals and businesses to access vital financial services. banks are held to a higher standard, and the risk of banking sector failure has been reduced. the basel accords have also proven to be an effective tool for regulating the banking system, increasing confidence in the sector and ultimately supporting the global economy.

巴塞尔协议三大支柱的核心

以下是对巴塞尔协议三大支柱“市场参与者准入和答责制,可行金融监管系统,金融稳定局”核心内容的解释:

1、市场参与者准入和答责制:巴塞尔协议要求促进更广泛,越来越公开的金融市场参与,并降低金融服务成本。针对主体活动,将更严格地采取“准入-禁止”模式,当有欺诈,滥用市场价格不公正或不道德行为时,监管机构将积极提出投诉作出处理,并以有效的措施帮助恢复市场正常秩序,使投资者也能获得公平的待遇。

2、可行金融监管系统:巴塞尔协议强调建立可行金融监管系统,加强金融行为者遵守法律法规的要求。金融(各项)服务的提供者必须承担责任,实行严格的规章制度,努力管理金融风险,制定明确的检查程序和机制,以避免不必要的损失。

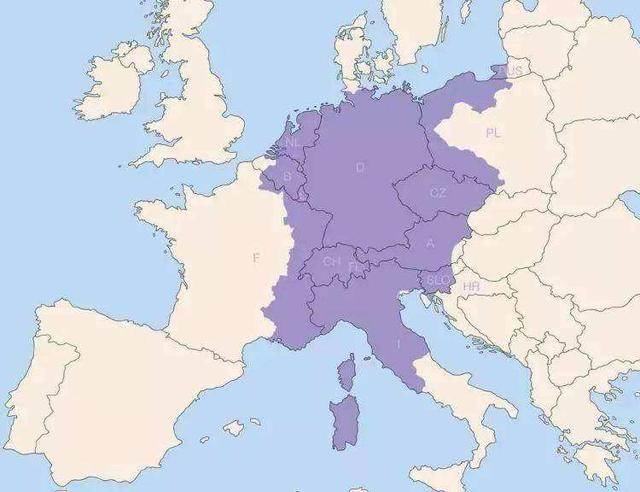

3、金融稳定局:巴塞尔协议支持建立金融稳定局,以加强金融活动的监管和管理。它由主要国家及政府机构共同构成,可以更有效地发现并衡量金融系统发生的危机,并采取适当措施放缓或抵御金融危机,保护金融稳定和资源利用,维护金融系统的发展。

总之,巴塞尔协议的三大支柱旨在改善金融市场的稳定性,提高参与者的准入和答责制度,加强金融监管,并形成一个有助于金融系统稳定和可持续发展的金融稳定局,来更有效地管理金融市场。